|

Does the Clean Energy Program still offer rebates for solar projects?

We no longer provide upfront rebates for solar systems; incentives are now provided thorugh Solar Renewable Energy Certificates (SRECs). Solar projects must be registered through the SREC Registration Program (SRP) to ensure eligibility for generating NJ SRECs.

-Back to top-

How long will it take to receive an acceptance letter for my solar project once I submit my SRP registration package?

As long as the SRP package is complete, it typically takes about 2 to 3 weeks. Incomplete registrations are returned to the registrant.

When will I get my New Jersey certification number?

When the inspection has passed or has been waived, the project status will be moved to "Complete". A notification will be sent with the New Jersey certification number within 2-3 weeks from the date the inspection report is received or the date of the waiver letter.

-Back to top-

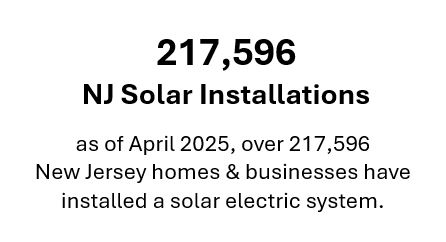

How has New Jersey become such a leader in solar energy?

New Jersey is one of the fastest growing markets for solar photovoltaics in the U.S. The success is due to New Jersey’s solar financing model, which relies on strong Renewable Portfolio Standards (RPS).

-Back to top-

Why is New Jersey considered a ‘model program’ for solar development? Since the inception of the New Jersey’s Clean Energy ProgramTM (NJCEP) in 2001, New Jersey has developed a model program and an integrated approach to solar development that includes:

- A strong RPS with a solar requirement of 2.05% in Energy Year 2014 and progressively higher percentages in each succeeding year;

- A Solar Alternative Compliance Payment (SACP) schedule through 2028 set high enough to motivate compliance, create demand for Solar Renewable Energy Certificates (SRECs), and build investor confidence in the market;

- Excellent Interconnection and Net Metering Standards that have made it much easier to connect to the distribution system and be compensated at retail electric rates for the generation of clean, emission-free electricity;

- An SREC Registration Program that facilitates access to the SREC tracking system and marketplace which provides a revenue stream and long term financing options for solar installations.

-Back to top-

What has been the result of this integrated approach?

In 2001, the Clean Energy Program had only six solar installations. Over the past 12 years, the program completely transitioned from a rebate only program to a market based program through the sale of SRECs. In just four years of existence, the SREC Registration Program has contributed over 88% of the installed solar capacity while the rebate programs, which have now been phased out, account for the other 12%.

-Back to top-

What are your goals for the growth of New Jersey’s solar program?

New Jersey’s solar industry has seen substantial growth over the last few years and is well positioned to continue to grow. The New Jersey Legislature passed new solar legislation in 2012 that accelerates the state’s Solar Renewable Portfolio Standard (RPS); extends the RPS to the year 2028; extends a REC life to five years; and adjusts the Solar Alternative Compliance Payment (SACP), among other things.

This law changes the NJ RPS solar requirement to an annual percentage from an annual fixed Gigawatthours (Gwhrs) requirement (see tables below).

RPS

EY 2014 2.050%

EY 2015 2.450%

EY 2016 2.750%

EY 2017 3.000%

EY 2018 3.200%

EY 2019 3.290%

EY 2020 3.380%

EY 2021 3.470%

EY 2022 3.560%

EY 2023 3.650%

EY 2024 3.740%

EY 2025 3.830%

EY 2026 3.920%

EY 2027 4.010%

EY 2028 4.100%

SACP

EY 2014 $339

EY 2015 $331

EY 2016 $323

EY 2017 $315

EY 2018 $308

EY 2019 $300

EY 2020 $293

EY 2021 $286

EY 2022 $279

EY 2023 $272

EY 2024 $266

EY 2025 $260

EY 2026 $253

EY 2027 $250

EY 2028 $239

-Back to top-

How do New Jersey’s program participants recover the cost of installing a solar system?

Program participants rely on a combination of electricity cost savings through net metering, selling SRECs through the RPS marketplace, federal tax credits or grants and depreciation benefits to reduce the total cost of installation and drive their investment in solar.

-Back to top-

How does market-based financing work?

Electricity suppliers and providers, the primary purchasers of SRECs, are required to pay a Solar Alternative Compliance Payment (SACP) if they do not meet the requirements of New Jersey’s solar RPS with SRECs retired. As SRECs are traded in a competitive market, the price may vary significantly. The actual price of an SREC during a trading period can and will fluctuate depending on supply and demand.

-Back to top-

What is “Net Metering”?

In New Jersey, Electric Distribution Companies and third party electric suppliers are required to credit customers with solar systems or other renewable energy generators for each kilowatt-hour produced on an annual basis. The customer-generator reduces consumption for electricity with their renewable energy system during a monthly billing cycle with any excess generation being credited at retail rates on the following month’s bill. Should excess generation accrue to the end of an annual period, the customer-generator is compensated for any remaining credits at the wholesale power rate by the Electric Distribution Company or their third party electric supplier.

In New Jersey, all BPU-regulated Electric Distribution Companies and electricity suppliers offer net metering to their residential and commercial customers that generate electricity on the customer’s side of the meter, using Class I renewable energy sources, provided that the generating capacity of the customer-generator’s facility does not exceed the customer’s annual electric consumption.

Together, our interconnection and net metering rules ensure solar generators are compensated for the clean, renewable energy they are generating, and that New Jersey ratepayers share in the benefits of solar and other small renewable energy generation.

-Back to top-

NJ has some of the best interconnection and net metering policies in the country. How do they work and why are they so beneficial to consumers?

New Jersey was one of the first states to streamline its interconnection rules to ensure that customers with small on-site renewable energy systems could easily connect to the grid and receive compensation from the utility.

New Jersey now requires utilities to follow a standardized process, making it easy to connect to the grid. This is critical to getting the full value of small generation systems for both the customer and for New Jersey.

One of the key benefits of solar electric generation, for example, is that it can offset peak demand. During the summer, when air conditioners are running full tilt, solar electric systems are also producing at near peak capacity reducing strain on the distribution systems and the need for heavily polluting sources of peak generation.

-Back to top-

Where can I find more information on New Jersey’s EDC solar financing programs?

Information on New Jersey’s EDC solar financing programs is available here.

-Back to top-

What is a Solar Renewable Energy Certificate (SREC)?

SREC stands for Solar Renewable Energy Certificate and is a type of clean energy credit in the form of a tradable certificate useful for demonstrating compliance in state RPS markets. In New Jersey’s RPS rules, an SREC is issued once a solar facility has generated 1,000 kWh (1MWh) through actual metered production. The SREC represents all the clean energy benefits of electricity generated from a solar electric system. SRECs can be sold or traded separately from the power, thus providing solar system owners a source of revenue to help offset the cost of installation.

-Back to top-

How do SRECs help finance solar development?

New Jersey’s RPS requires that electric suppliers and providers retire SRECs in scale with their retail electricity sales in increasing amounts each year through 2028 and beyond. This long term demand for SRECs provides owners a predictable source of additional revenue that can facilitate long term financing for solar installations.

-Back to top-

Who owns the SRECs produced by a solar generator?

SRECs are owned by the owner of the solar generating facility, unless sold or granted by the owner to another entity. The value of an SREC is determined by the market subject to demand and supply.

Who buys SRECs?

Solar system owners can choose to sell their SRECs to a broker, aggregator, or Load Serving Entity (LSE) i.e. the electric suppliers and providers, who must buy SRECs to meet their RPS obligations. Some solar installers or project developers will offer to buy the SRECs as part of the project financing, thereby reducing the installation costs and hence the amount of capital needed up front to finance a project. All customers considering financing options for a solar installation should ask their installer about the value of SRECs and who will have the rights to claim them. Prospective investors in solar energy equipment are advised to seek alternative quotes from at least three project developers or installers. A courtesy listing of project developers is available at http://www.njcleanenergy.com/findavendor.

New Jersey’s Electric Distribution Companies (EDCs), who provide regulated electric transmission and distribution services, offer solar finance programs that provide competitive long term contracts for SREC off take or loans in exchange for the SREC amortization. The SRECs procured under each model are auctioned to buyers for use toward NJ RPS compliance by electric generation suppliers and providers.

-Back to top-

Why can't I just sell my SRECs to the utility company directly?

The utilities do NOT have an RPS obligation. Rather, the RPS requirements are mandatory to the suppliers and providers of electric generation supply. However, the Board of Public Utilities has approved EDC Solar Finance programs that competitively solicit long term contracts for SRECs (open to ACE, JCP&L or Rockland customers) or provide loans in return for SRECs (PSE&G).

-Back to top-

How long will my system generate SRECs?

Solar electric generation facilities that are accepted and installed in accordance with all requirements of the SREC Registration Program are eligible to generate NJ SRECs for a period of 10 or 15 years. This period is known as the SREC Qualification Life which begins on the date on which the facility was interconnected to the local electric distribution system; and ending on the first May 31 that is at least 10 or 15 years after the date of completion of the interconnection.

How do I determine if I am eligible for 10 or 15 year SREC Qualification Life?

The Clean Energy Act, signed by Governor Murphy on May 23, 2018, included the following provision: "For all applications for designation as connected to the distribution system of a solar electric power generation facility filed with the Board after the date of enactment of P.L. 2018 c. 17 (C. 48:3-87.8 et al.) the SREC term shall be 10 years." L. 2018, c. 17, 2(d)(3).

On October 29, 2018 the New Jersey Board of Public Utilities clarified the language above as follows: NJ SREC Update: Implementation of New 10-year SREC Term.

How is the price of the SREC determined?

The price of an SREC is determined by a number of factors, including supply and demand for SRECs in any given year and the SACP level. Electric suppliers and providers (load serving entities) are required to pay the SACP if they do not meet the Solar RPS through purchasing SRECs. Generally, SACP levels are set by the BPU above the SREC levels necessary for electric suppliers to have an incentive to purchase SRECs instead of paying SACPs and necessary to provide an internal rate of return attractive for enough solar capacity to reach the RPS requirements.

-Back to top-

Does the BPU guarantee SREC prices?

No. SREC pricing is neither determined nor guaranteed by the BPU. SRECs trade in a competitive market, and SREC pricing is determined by competitive factors such as supply and demand. SRECs are expected to trade somewhere below the SACP. It should be noted that SRECs are a market instrument to assist in financing solar energy development. The actual price of an SREC during a trading period can and will fluctuate depending on supply and demand, contract terms and other factors. The BPU makes no representation as to current or future prices of SRECs, and this risk is entirely assumed by the registrant or investor.

-Back to top-

Does money from the sale of SRECs need to be treated as taxable income?

Prospective investors in solar energy equipment are advised to consult their accountant or other tax professional with any tax related questions.

What happens if I sell my house?

Ownership of the solar energy system and the SRECs it generates typically transfers to the new property owner when a home is sold. If you sell your house, you must download the 'Major System Change Form' from the PJM-EIS Generation Attribute Tracking System (GATS) website, fill that out, and submit it to the program administrators at www.pjm-eis.com. The new owner will also be required to submit a new attestation form.

There are several alternative models of solar energy system ownership in New Jersey’s solar market. Ownership of SRECs often remains the same as ownership of the solar energy system. Frequently, the ownership of SRECs is transferred by the owner of the solar energy system to a third party in exchange for a reduction in installed costs. It is also common for property owners to lease their property to a solar energy system owner in exchange for reduced electricity costs under a Power Purchase Agreement. SREC ownership under each of these models must be recorded with the SREC administrator, currently PJM-EIS GATS (Generation Attribute Tracking System).

Can I move my solar energy system to a new property?

Yes. In this case you must download the 'Major System Change Form' from the PJM-EIS GATS home page, fill that out, and submit it to the GATS program administrators.

-Back to top-

-Back to top-

What if I change or add additional equipment to my solar system?

If you make any changes, such as adding additional modules, changing inverters or changing your meter, you must fill out and submit a Major System Change Form to GATS.

-Back to top-

If my system was installed prior to receiving an SRP Acceptance Letter, do SRECs go back to the interconnection date?

Yes, SRECs can begin with the interconnection date as long as GATS is still issuing SRECs for the current reporting year. The reporting year in New Jersey runs from June 1 to May 31.

-Back to top-

|

.jpg)